Managing finances is one of the most challenging aspects of running a small business or freelancing. Keeping track of expenses, invoices, and receipts can quickly become overwhelming without the right tools. Expense tracker apps provide an organized, efficient way to manage money, reduce errors, and make smarter financial decisions. With the rise of digital tools, these apps have become essential for professionals who want to save time and improve their financial health.

What Is an Expense Tracker App?

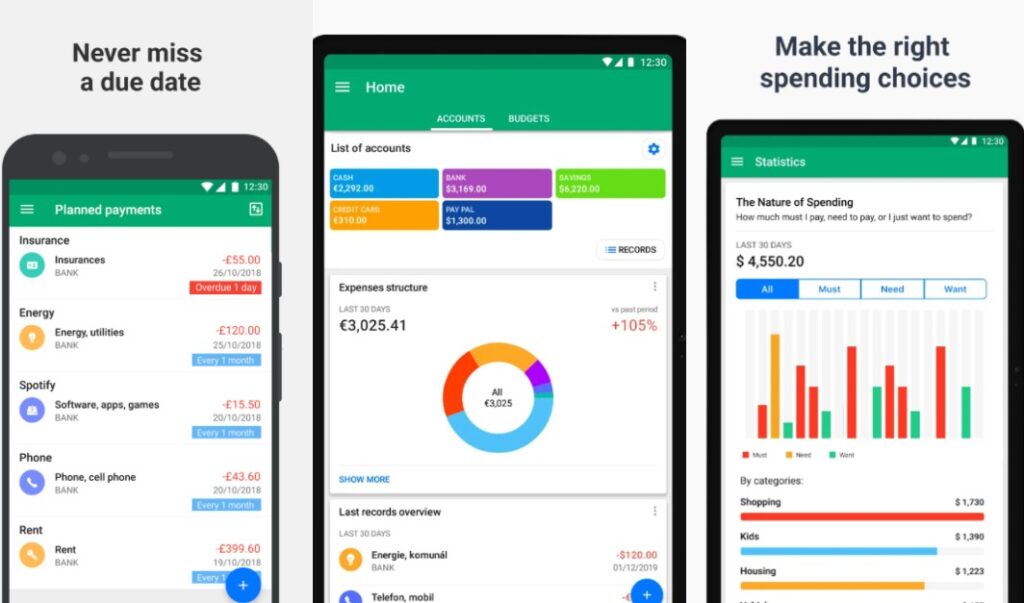

An expense tracker app is a digital tool designed to help users monitor their income and spending in real time. It simplifies budgeting, categorization of expenses, and financial reporting.

Who uses expense tracker apps?

- Small business owners managing multiple revenue streams

- Freelancers juggling client payments and personal finances

- Entrepreneurs tracking project costs

- Remote workers seeking efficient budgeting solutions

What makes these apps stand out?

- User-friendly dashboards for quick insights

- Automated expense categorization to reduce manual work

- Cloud synchronization for access across devices

- Integration with banking and payment platforms

Key Features

Expense tracker apps come with a variety of features aimed at simplifying financial management:

- Automatic expense categorization – sorts transactions by type for easy tracking

- Receipt scanning – capture and store receipts digitally

- Budget tracking – set limits for categories and monitor spending

- Multi-currency support – useful for freelancers with international clients

- Customizable reports – generate monthly, quarterly, or yearly financial summaries

- Invoice management – create, send, and track client invoices

- Alerts and reminders – notifications for upcoming bills or low budgets

- Cloud backup – ensure data is safe and accessible anywhere

Benefits of Using Expense Tracker Apps

Using an expense tracker app improves productivity and financial accuracy for small business owners and freelancers.

Key benefits include:

- Time-saving – automates tedious tasks like manual entry

- Financial clarity – see exactly where money is going

- Improved budgeting – prevent overspending with alerts

- Error reduction – digital tracking reduces human mistakes

- Easy tax preparation – organized records simplify filings

- Better decision-making – insights into spending patterns and trends

- Scalability – accommodates growing business needs

Recent Trends

Expense tracker apps have evolved significantly in 2025, incorporating smarter features and improving user experience:

- AI-based transaction categorization for faster bookkeeping

- Integration with e-commerce and payment platforms

- Enhanced mobile interfaces for on-the-go access

- Customizable dashboards for better analytics

- Advanced security measures like biometric login and encryption

- Support for subscription tracking and recurring expenses

- Cloud-based collaboration for team accounting

Pros of Expense Tracker Apps

| Pros | Description |

|---|---|

| Easy to Use | Simple and intuitive interface suitable for all users |

| Time Saving | Helps complete financial tracking faster and efficiently |

| Reliable Performance | Runs smoothly with minimal bugs or crashes |

| Offline Support | Works without active internet in some features |

| Regular Updates | Developers frequently fix issues and add new tools |

| Free Version Available | Offers a good range of features without payment |

Cons of Expense Tracker Apps

| Cons | Description |

|---|---|

| Limited Free Features | Some advanced tools require a subscription |

| Ads in Free Version | Users may experience occasional advertisements |

| Requires Permissions | Needs access to banking or storage for optimal functionality |

| Occasional Bugs | Minor glitches may occur after updates |

| Large File Size | May take up significant storage space on devices |

| Internet Needed | Some features depend on active connectivity |

Alternatives of Expense Tracker Apps

| Alternative | Description |

|---|---|

| App A | Known for fast performance and user-friendly design |

| App B | Offers more customization options and better offline features |

| App C | Focuses on privacy and minimal ads |

| App D | Popular among freelancers for managing client payments |

| App E | Provides affordable premium options and frequent updates |

Why to Use Expense Tracker Apps

Expense tracker apps are indispensable for anyone who wants to manage finances efficiently. They reduce the stress of manual bookkeeping, help stay within budgets, and provide actionable insights into spending patterns. For freelancers, these apps simplify client invoicing and recurring expense management. Small business owners gain clarity on profitability and cash flow, making informed decisions easier.

Mistakes to Avoid

Even with the best apps, some common mistakes can hinder financial management:

- Not updating expenses regularly – leads to inaccurate records

- Ignoring budget limits – defeats the purpose of tracking

- Overlooking app security – always use encryption and secure login

- Relying solely on free features – premium tools may improve efficiency

- Neglecting reports – periodic review is essential for insight

Final Thoughts

Expense tracker apps are more than just a convenience—they’re a necessity for small business owners and freelancers who want to stay organized and make smarter financial choices. By choosing the right app, taking advantage of its features, and avoiding common mistakes, you can simplify your financial workflow and focus more on growing your business. Start tracking expenses today to gain clarity, control, and confidence over your financial future.